Content

In case your Irs explores and you may alter the government income tax return, and you also are obligated to pay additional taxation, report this type of alter to your FTB inside 6 months. Its not necessary to share with the new FTB in case your alter don’t increase your Ca taxation liability. Should your changes made by the brand new Irs cause a refund due, you must file a claim for reimburse within two years.

What direction to go If you have Previously Registered to have Personal Shelter Pros

In the event the there are no differences when considering your government and you may Ca earnings otherwise deductions, do not document Plan California (540), Ca Alterations – Residents. For more information, see ftb.ca.gov and appear to have disclosure responsibility. To have a child to help you qualify as your foster child to possess HOH aim, the little one need to be set with you from the an authorized position service or because of the acquisition from a legal.

Credit card

Your own sum will ensure you to Alzheimer’s condition receives the interest, search, and you will info they is definitely worth. To have purposes of California tax, records in order to a wife, spouse, otherwise partner in addition to refer to a wjpartners.com.au visit our web site california Entered Domestic Relationship (RDP), except if or even specified. Once we make use of the initials RDP, they reference each other a ca entered home-based “partner” and you can a ca joined residential “relationship,” while the applicable. Private taxpayers get consult you to definitely the reimburse become digitally deposited to the several checking otherwise checking account. For example, you could potentially demand section of your own refund visit your checking membership to utilize today plus the other people for the bank account to store to possess after.

- That it number was transmitted out over their amended Function 540 and you will be entered on the web 116 and you may range 117.

- You will find the brand new navigation and you will account number on your take a look at otherwise because of the contacting debt organization.

- Of a lot credit is actually limited to a specific payment otherwise a particular dollar number.

- This is simply not you can to include all standards of your own Ca Money and Income tax Code (R&TC) in the recommendations.

- Such experts in addition to their partners have long started needing changes these types of conditions, which they considered unjust.

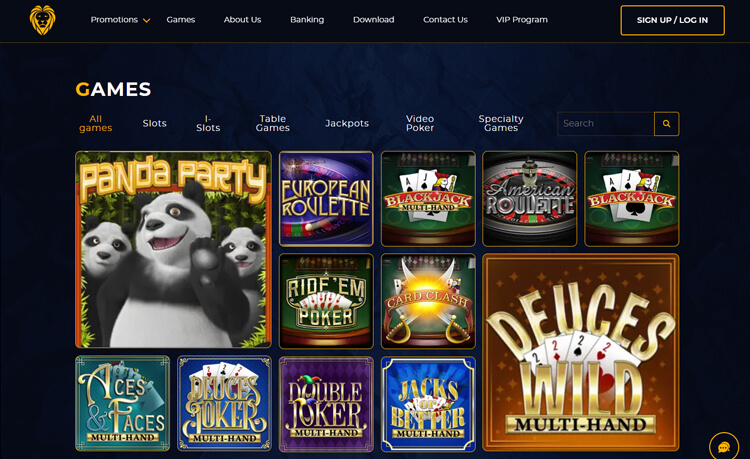

Rating 5 similar issues that include colorful signs will bring your hundreds of minutes a lot more than you may have gambled. There is one exclusion, while the those individuals who have been choosing Social Shelter as the ahead of Will get 1997 can still predict their payments a while earlier. The fresh arrival out of professionals could be based on for each and every recipient’s delivery time. Public Shelter benefits increased because of the 3.2 percent this current year, prior to the 2009 determined cost-of-living variations (COLA). On the June 3rd, 15,100000 firefighters and supporters, protesting the fresh endangered closings out of 20 firehouses, have been added by the UFA across the Brooklyn Link to City Hall Playground.

LODD Funeral service Finance Committee

With additional electronic challengers increasing, credit unions deal with improved stress to draw and you may keep dedicated customers. To keep competitive, it’s vital to streamline membership opening techniques and boost digital banking feel. This article examines about three secret techniques to drive put gains and you may consumer retention.

Getting in touch with the fresh Operation Tax Panel

It percentage is actually paid off straight to ACI Repayments, Inc. according to the quantity of your own taxation percentage. For each and every taxable seasons of your limit, taxpayers may make a keen irrevocable election to receive a yearly refundable borrowing from the bank number, in the future income tax many years, to own business loans disallowed as a result of the 5,100,000 restrict. The brand new election must be generated a-year by doing setting FTB 3870, Election for Refundable Borrowing, and you will attaching they to exclusive, punctual submitted tax return. The fresh tips available with California taxation versions are a list of California taxation law and so are just designed to assistance taxpayers inside making preparations their state tax efficiency. We is information that’s best on the greatest count from taxpayers on the small space offered.

Filling out The Tax Return

Come across “Volunteer Contributions Financing Meanings” to learn more. To prevent decrease within the processing of one’s tax return, enter the correct number on the internet 97 due to range a hundred. Fundamentally, taxation should not be withheld to the government Mode 1099-MISC otherwise Mode 1099-NEC. If you’d like to pre-shell out taxation on the earnings advertised for the federal Function 1099-MISC otherwise Form 1099-NEC, play with Setting 540-Es, Projected Income tax for individuals. To stop a delayed regarding the handling of your own income tax get back, enter the right amounts on the internet 71 due to range 73.