For example, positive cash flow is available more quickly than fixed assets such as goodwill, for which you would have to wait to sell it to recover the money. Shareholders’ equity is calculated by subtracting a company’s liabilities from its assets. This shows how much of the company belongs to its shareholders or owners. The Directors Loan Account (DLA) tracks all financial transactions between a director and the company.

Balance Sheet Analysis

Because balance sheets typically include the same categories of information, they also allow comparison between different businesses of the same type. Employees usually prefer knowing their jobs are secure and that the company they are working for is in good health. Shareholder equity is the money attributable to the owners of a business or its shareholders. It is also known as net assets since it introducing xeros new app marketplace is equivalent to the total assets of a company minus its liabilities or the debt it owes to non-shareholders. The accounting balance sheet gives an overview of the company’s assets, while the functional balance sheet focuses on the management and use of financial resources. The Balance Sheet and Profit and Loss Statement are essential reports for understanding your business’s financial health.

What are debits and credits?

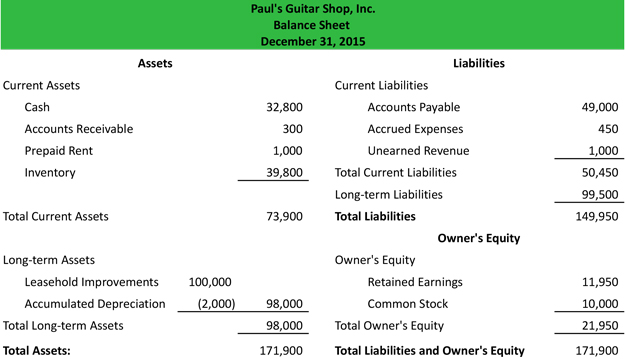

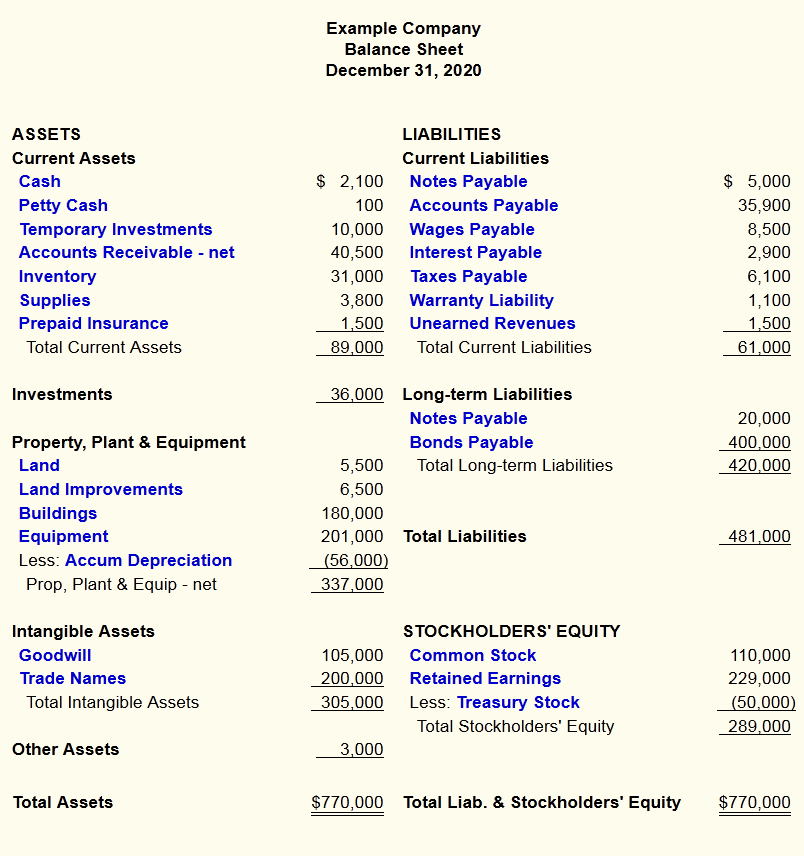

Assets are typically listed as individual line items and then as total assets in a balance sheet. Investors, creditors, and internal management use the balance sheet to evaluate how the company is growing, financing its operations, and distributing to its owners. It will also show the if the company is funding its operations with profits or debt. To complete your balance sheet template you’ll need to add in details about the debts and liabilities your company owes. Shareholder equity is not directly related to a company’s market capitalization.

Balance Sheets are Static

You will no longer have any doubts about the classification of shareholders’ equity, fixed assets, trade payables and stocks. The distinction between uses (assets) and resources (liabilities) will become clear. The current ratio is calculated by dividing the total current assets by the total current liabilities. Liabilities represent financial obligations a company must fulfil in the future, including loans and lease payments.

- A Balance Sheet is an accounting report required by all companies registered at Companies House and is helpful for self-employed to see their financial health.

- The Profit and Loss Statement or Income Statement shows a company’s income and expenses over a specific period, such as a month or year.

- Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company.

- The color formatting abides by general financial modeling best practices, which make building a financial model easier for the one creating the model and for purposes of auditing.

The corporate balance sheet: Assets, liabilities, and owners’ equity

A balance sheet is a type of financial statement that reports all of your company’s assets, liabilities, and shareholder’s equity at a given time. There are three main ways to analyze the investment-quality of a company through its balance sheet. First, the fixed asset turnover ratio (FAT) shows how much revenue a company’s total assets generate. Second, the return on assets (ROA) ratio shows how much profit is being generated from its total assets. Lastly, the cash conversion cycle (CCC) shows how well a company is managing its accounts receivables and inventory.

11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Balance sheets also play an important role in securing funding from lenders and investors. These ratios can yield insights into the operational efficiency of the company. These operating cycles can include receivables, payables, and inventory.

It is important to understand that balance sheets only provide a snapshot of the financial position of a company at a specific point in time. It is helpful for business owners to prepare and review balance sheets in order to assess the financial health of their companies. Businesses should be wary of companies that have large discrepancies between their balance sheets and other financial statements. It may not provide a full snapshot of the financial health of a company without data from other financial statements.

Analyzing all the reports together will allow you to better understand the financial health of your company. The fundamental accounting equation states that a company’s assets must be equal to the sum of its liabilities and shareholders’ equity. Balance sheets can tell you a lot of information about your business, and help you plan strategically to make it more liquid, financially stable, and appealing to investors. But unless you use them in tandem with income statements and cash flow statements, you’re only getting part of the picture. Learn how they work together with our complete guide to financial statements. The balance sheet is one of the three main financial statements, along with the income statement and cash flow statement.

The data from financial statements such as a balance sheet is essential for calculating your business’ liquidities. In studying Analyzing Balance Sheets for the CFA Exam, you should learn to understand the components and structure of a balance sheet, including assets, liabilities, and equity. Analyze the methods used to assess liquidity, solvency, and financial leverage through ratios such as the current ratio, quick ratio, and debt-to-equity ratio. Evaluate the significance of asset quality, inventory management, and accounts receivable turnover in determining a company’s financial health. While income statements and cash flow statements show your business’s activity over a period of time, a balance sheet gives a snapshot of your financials at a particular moment.