To maintain the accounting equation’s net-zero difference, one asset account must increase while another decreases by the same amount. The new balance for the cash account, after the net change from the transaction, will then be reflected in the balance category. For example, a CPA might use a T-account — named because of its physical layout in the shape of a T — to track just the debits and credits in a particular general ledger account.

- The accounts codes structure seeks to organize the general ledger by grouping similar account types together in ranges.

- In this case, your revenue accounts could start with number four, your cost of goods sold accounts start with number five and your expense accounts start with number six.

- In this instance, one asset account (cash) is increased by $200, while another asset account (accounts receivable) is reduced by $200.

- Subsidiary ledgers include selective accounts unlike the all-encompassing general ledger.

- For instance, your asset accounts may start with “1,” your liability accounts may begin with “2,” and so on.

- The total debit amount must always be equal to the total credit amount.

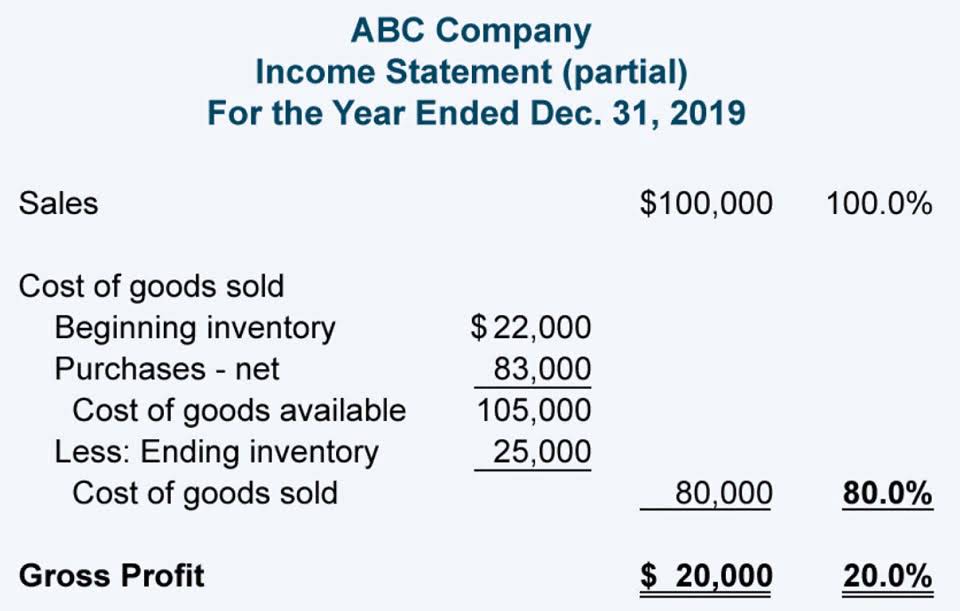

It includes direct costs, such as freight, storage, shipping, direct labor to build these products, and the cost of parts. If you’re running a larger company, you’ll likely want to track your COGS by department or product line in your chart of accounts. Your operating revenue is generated from your company’s primary activities. For instance, if you’re an artist, the revenue from the art you sell would go here. Larger companies will likely have several areas bringing in operating revenue and might want to track these revenues across divisions, departments, or product lines.

Double Entry Bookkeeping

Depending on the type of business smaller or larger ranges can be allocated to each account type to allow for expansion. In addition it is always good practice to leave spaces between allocated account codes to allow room for additional codes to be inserted at a later stage. Separating these accounts from the main ledger removes a large amount of detail and allows different staff to work on different aspects of the accounting records.

Each department now has its own account and the total of the three accounts will represent the total wages expense. A general ledger (GL) is a comprehensive document comprised of individual accounts that catalog each financial transaction in the course of your organization’s existence. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own.

Digit Account Code Structure Example

Plus, you can use your GL in tandem with bank statements or other source documents (like receipts, bills, invoices, or checks) to validate data and even fix discrepancies on the spot. Plan for the future with 3 essential accounting reports that help you turn the data you have into the insights you need. In a summary report it is possible to get to all the transactions within an account ledger by clicking on the account name. A business can have as few as 5 accounts ledgers and a large business can end up with 100’s of accounts ledgers.

General ledgers are organized into accounts, or types of transactions, which are listed in the general ledger’s chart of accounts. This includes loans, accounts payable, your mortgage, credit chart of accounts numbering card balances, payroll taxes, and more. For example, when you make a payment on a loan, you would credit your cash account (an asset account) and debit the loan account (a liability account).

Create a free account to unlock this Template

These accounts include assets, liabilities, owner’s equity, revenue, and expenses. The totals calculated in the general ledger are then entered into other key financial reports, notably the balance sheet — sometimes called the statement of financial position. The balance sheet records assets and liabilities, as well as the income statement, which shows revenues and expenses. An accounting ledger records transactions and helps generate financial statements for investors, creditors, or even regulators.

CAS by the numbers – Accounting Today

CAS by the numbers.

Posted: Fri, 30 Dec 2022 08:00:00 GMT [source]

You’ll make sure every transaction is accurate and has been correctly recorded as both a credit and debit in the appropriate accounts. For the most part, general ledgers included with accounting software come pre-built with the most common account types (Figure A). Depending on the software and plan, you can also add custom accounts unique to your specific business. The next step in the general ledger and financial reporting cycle is to prepare an unadjusted trial balance. Double-entry bookkeeping is the most common accounting system for small businesses.

Is a cash book an accounting ledger or a journal?

This allows for easy tracking, retrieval, and reference of financial data. Each transaction is entered into the appropriate account as a debit or credit. When using general ledger accounting, a company compiles financial data from all sectors of the business in a single, comprehensive spreadsheet. All money entering and exiting the company is documented in a general ledger account. Here’s an overview of general ledger accounting and ways you can use it to monitor your organization’s financial transactions. It’s determined by subtracting your business liabilities from your assets.

- Each entry in the general ledger includes a reference number that states the source of the information.

- Here’s an example of how this section could be organized in your chart of accounts.

- Then, the balance of each of the General Ledger Accounts is posted in your Trial Balance Sheet.

- An accurate ledger is also a good safeguard against issues like embezzlement and fraud.

- Debits increase assets and expenses, while they decrease liabilities, equity, and revenue.